HAIR COLOR SHINES

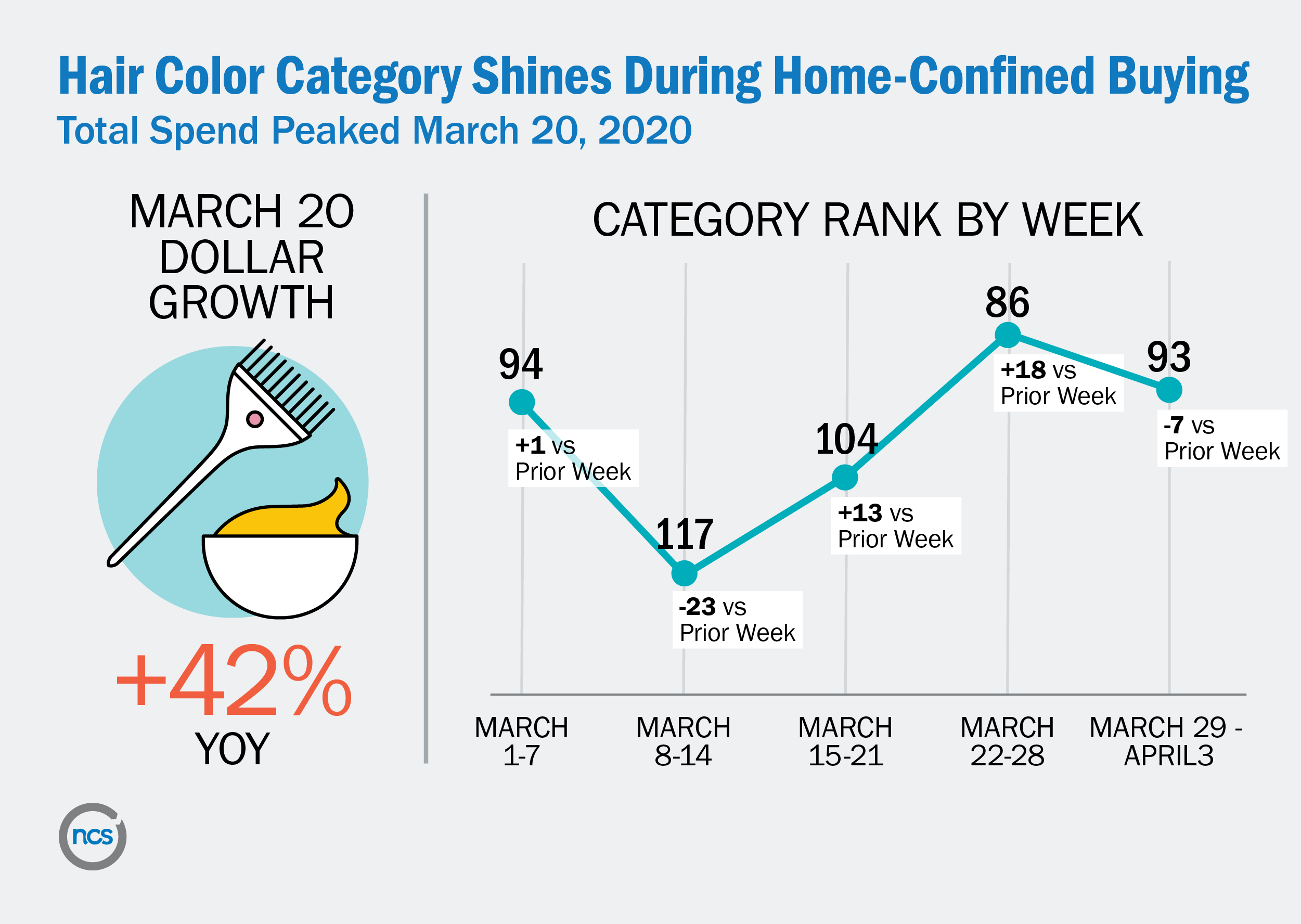

When consumers stocked up on the essentials at the height of Extreme Buying from March 11-21, 2020, hair care wasn’t at the top of their lists. Americans were more worried about whether the nation would run out of toilet paper, keeping their households germ-free, and how they’d manage to feed their families with social distancing mandates and restaurants closing. No surprise, then, that hair color dropped to #117 in CPG category sales rankings the week ending March 14, 30 spots lower than one year prior.

One week later, though, consumers realized this COVID-19 pandemic wasn’t going away any time soon. While video calls prevented the need for professional attire from the waist down, one thing we learned we couldn’t hide: our heads.

Left with no other choice, more Americans are DIY-ing their roots. With hair coloring services making up 21% of U.S. hair salon revenue in 2019 according to IBISWorld, U.S. consumers who typically professionally color their hair are directing their dollars to home dye kits. This has been evident in the rise of hair color product sales: the CPG category rose to #104 the week ending March 21, and #86 the week ending March 28. Hair coloring products spiked on Friday, March 20, at spending levels 42% higher than one year prior, with consumers going into the weekend putting fate into their own hair.

As consumers settle into a new stage of Home-Confined Buying, the hair color category continues to shine. Now is the time for hair care brands to reach out to consumers (figuratively) who want to look sharp on video with the help of some color.