Gen Z’s Interest In The Sober Curious Movement Increases 53%, From 2023 To 2024, According To A New NCSolutions Analysis

- Over one-third of Gen Zers (34%) say they’ll try a new beverage product if it’s marketed as aligning with the sober curious lifestyle.

- Nearly half (45%) of Gen Z say social media is the most effective advertising channel to inform them about new nonalcoholic options.

- The most popular month to purchase alcohol in 2023 was December (up 16% over November), and the least popular was January (down 24% compared to December 2022)

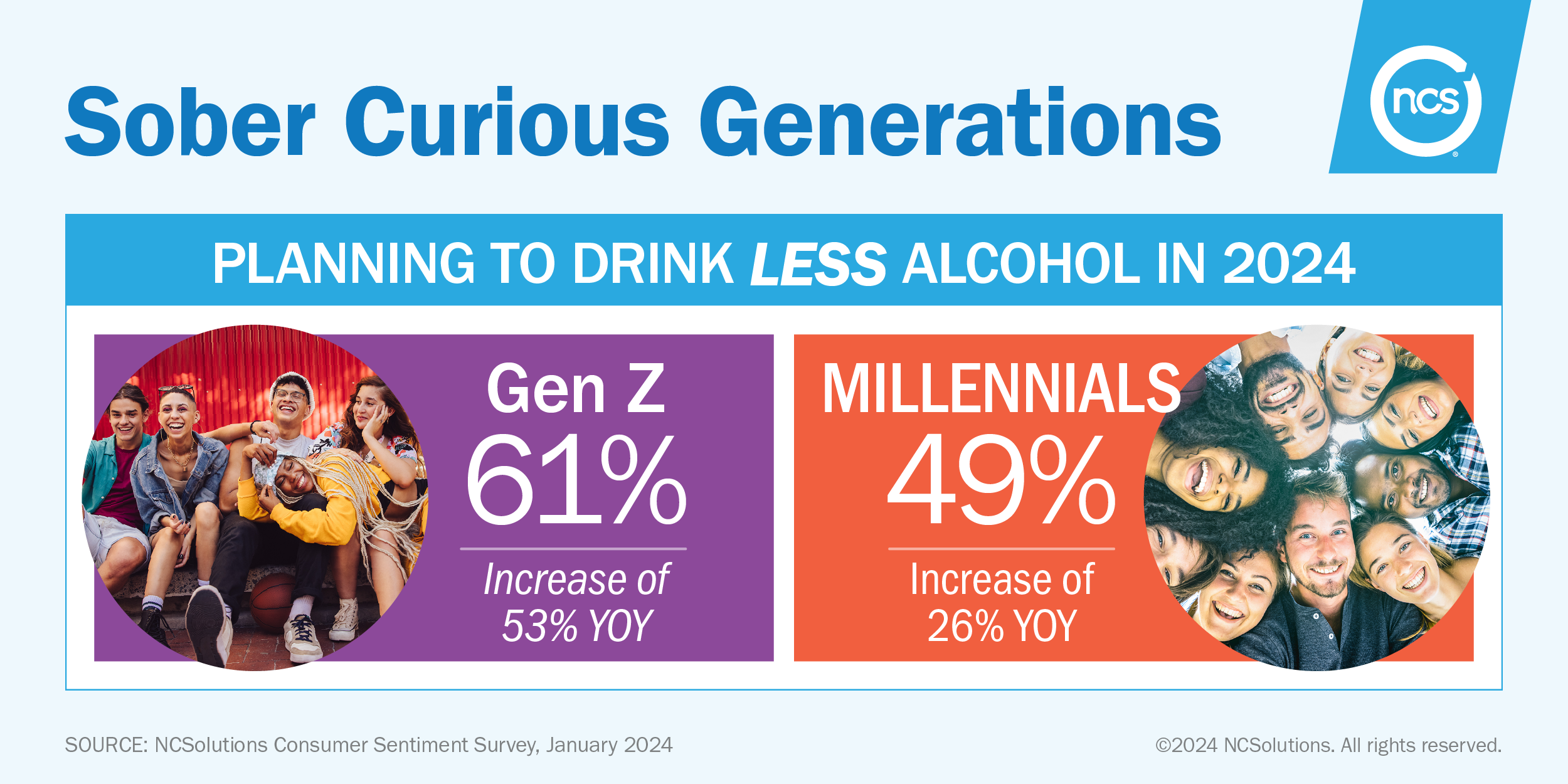

NEW YORK, JANUARY 23, 2024 – The share of Gen Zers born between 1997 and 2002 who say they plan to drink less alcohol in 2024 jumped 53% year over year. Sixty-one percent say they plan to cut back on their alcohol consumption, compared to 40% who said they planned to drink less in 2023.

The findings are from the latest consumer sentiment survey about the sober curious movement, a follow-up to a similar survey conducted in January 2023. Both surveys were commissioned by NCSolutions (NCS). The findings also include an analysis of NCS’ proprietary consumer purchase data. NCS is the leading company for improving advertising effectiveness for the consumer packaged goods (CPG) ecosystem.

More millennials (born between 1981 and 1996) said they’d drink less in 2024 (49%), an increase of 26% from those surveyed a year before. Overall, 41% of all Americans plan to drink less in 2024, up from 34% the year before. Together, these findings indicate the sober curious movement gained strength over the last year, largely due to interest from younger generations.

“Nonalcoholic alternatives, once a niche category, are becoming more mainstream,” said Alan Miles, chief executive officer, NCSolutions. “Younger consumers are increasingly expressing a growing interest in healthier options for social drinking. Beverage brands have a real opportunity to engage and build brand loyalty with the next generation of consumers by focusing on the right combination of creative, product, placement and timing.”

Tap into Gen Z with sober curious lifestyle messages

Younger consumers say saving money and improving physical health are the top reasons they switch to a sober lifestyle. More than one-third (36%) of Gen Z say they’re going alcohol-free for their mental health.

This impacts the type of advertising most likely to influence purchases: over one-third of Gen Zers (34%) say they’re more likely to try a new beverage product if it’s aligned with the sober curious lifestyle, compared to 17% of all Americans. The finding adds further nuance to the marketing preferences of Gen Z, who are known to have an affinity for brands whose missions align with their values.

Nearly half (45%) of Gen Zers say social media is the most effective advertising channel to help them learn about new nonalcoholic beverage options, followed by internet searches (16%) and streaming TV (15%). In addition, nearly one in four (24%) have tried a nonalcoholic beverage because a celebrity or influencer endorsed it.

Mocktails are twice as popular as nonalcoholic beer

Sober curious consumers surveyed are twice as likely to choose a mocktail than a nonalcoholic beer. One in five (19%) Americans said they drank a mocktail in 2023, compared to one in 10 who drank nonalcoholic beer. More than one-third (37%) said they drank mocktails most often.

Mocktails were especially popular among younger generations in 2023. Thirty-seven percent of Gen Z said they drank mocktails last year, compared to 16% who said they had nonalcoholic beer and 10% who said they drank nonalcoholic wine.

Among millennials, 30% said they drank mocktails in 2023, compared to 15% who drank nonalcoholic beer and 9% who had nonalcoholic wine.

Seventeen percent of both millennials and Gen Z said they had tried THC and CBD-infused drinks in 2023.

December leads for nonalcoholic beverage sales

Interest in Dry and Damp January continues to expand. Consumers purchased the least amount of alcoholic beverages in January 2023 (down 24% from December 2022) and August 2023 (down 10% from July 2023), according to NCS purchase data. This follows a 19% drop in January 2022 compared to December 2021.

December was the most popular month of the year to buy alcohol in 2023, followed by May and March. Month-over-month purchases of alcohol in December increased 16% over November. This increase was two times higher than the 8% month-over-month increase in December 2022 and rose 8% in May, compared to April. By contrast, in 2022, the summer and winter holidays saw the highest increase in purchases of alcoholic beverages.

“Alcohol consumption is traditionally seasonal. Consumers purchase significantly more during December in preparation for the holidays,” Miles said. “In the past, we’ve seen alcohol sales rise during summer months, but now the peak is as early as May. Beverage brands have the opportunity to leverage the sober curious trend beyond January and into the summer months, targeting younger consumers with new summer-focused nonalcoholic products and health-oriented creative.”

Additional results are available on our website.

About NCS

NCSolutions (NCS) makes advertising work better. Our unrivaled data resources powered by leading providers combine with scientific rigor and leading-edge technology to empower the CPG ecosystem to create and deliver more effective advertising. With NCS’s proven approach, brands are achieving continuous optimization everywhere ads appear, through purchase-based audience targeting and sales measurement solutions that have impacted over $25 billion in media spend for our customers. Visit us at ncsolutions.com to learn more.

About the NCS Consumer Sentiment Survey

The consumer sentiment survey of 1,062 Americans was commissioned by NCS in December 2023 and was made up of U.S. adults ages 21+, who were asked about their drinking habits and preferences. Results were weighted to be representative of the U.S. population by age, gender, region, ethnicity, marital status, education level, and household income.

About NCS Purchase Data

NCS provides purchase insights to brands to help them target, optimize, measure and enable sales-based outcomes. NCS’s representative and balanced consumer CPG purchase data set consists of the industry’s preeminent and comprehensive sources. It includes actual purchase data (transaction information) from big-box retailers, supermarkets, drug stores, convenience stores and other retail channels at which American households buy CPG products spanning 340+ grocery categories. The NCSolutions purchase data was analyzed in January 2024.

Fair Use

When using this data and research, please attribute by linking to this study and citing NCSolutions.