Fueled by the Pandemic, Consumer Packaged Goods Purchases Grew 19% In 2020 Compared to 2019 According to NCSolutions

Nearly Half of Americans Have Tried New Brands or Shopped in New Categories Since the Start of the Pandemic According to a New NCS Consumer Survey

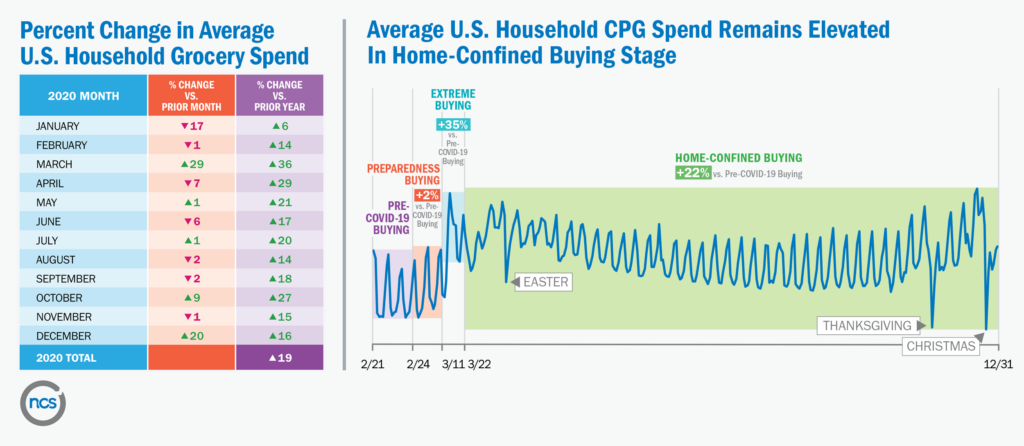

NEW YORK, January 20, 2021 — As consumers hunkered down at home during most of last year, their spending on consumer packaged goods (CPG) grew an average of 19% in 2020 compared to 2019 according to the latest data from NCSolutions, the leader in advertising effectiveness for the CPG industry.

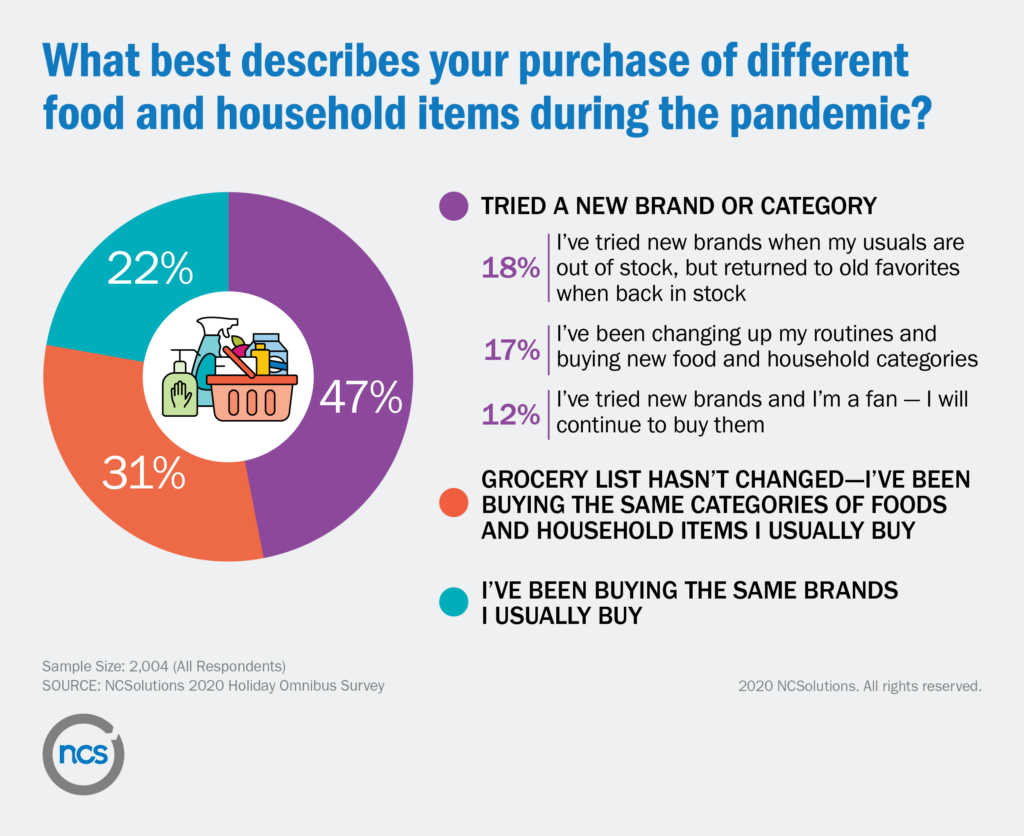

The COVID-19 pandemic caused a significant shift in CPG purchasing habits in 2020 — not just in how much consumers spent, but on what. According to a new NCS consumer survey of more than 2,000 adults, nearly half (47%) of Americans indicated they tried new brands and categories since the pandemic began.

Consumers are most open to trying a new snack food brand with 52% reporting they’re most likely to explore their options in this category. After snacks foods, consumers are most willing to experiment with beverages and cleaning products: 44% and 43% of consumers were most likely to try new brands in these categories, respectively.

“The increase in CPG spending coupled with the openness of consumers for new brands marks a clear opportunity for brands. Since the start of the pandemic, our teams at NCSolutions have identified several trends emerging with respect to brand loyalty: consumers are purchasing their favorite brands in greater quantities and at higher frequencies than before the pandemic, but they’re also more willing to experiment with competitive brands as they tire from pandemic living,” said Linda Dupree, CEO, NCSolutions. “ In response to these trends, many brands are refocusing their advertising efforts through the lens of brand loyalty. Some brands are doubling down on both their most loyal and newest buyers, focusing on these audiences to retain them, move them up the loyalty ladder and prevent them from straying to competitive brands.”

TIRING OF THE SAME OLD AND AWAITING INSPIRATION

When asked about their meal planning, some Americans voiced a sense of monotony with their current meal routines, with 34% eating the same meals regularly, 13% bored of their current meal rotation and 36% seeking out new ideas for meals. To inject some excitement into their daily routines, 41% are open to trying new recipes and products. Among those seeking out new meal ideas, this openness is even greater—more than two thirds of this group (67%) is game to try new recipes and products. Many reported these behaviors as new to them because of the pandemic.

Price, free samples, quality and recommendations by family or friends are the top factors that motivate consumers to try a new brand: when asked about what might motivate them to try a new brand, 54% of consumers stated price, 43% free samples, 36% quality and 36% family recommendations as the primary motivators respectively.

CONSUMERS STILL LOYAL TO OLD FAVORITES

Although consumers have partaken in unprecedented product trials this year, not all of the incremental spending is going toward trying new brands or new categories. Americans are purchasing their favorite brands in greater quantities and at higher frequencies than before the pandemic, with 31% of consumers claiming their grocery lists haven’t changed, 22% claiming to buy the same brands they usually buy and 18% returning to old favorites once back on shelves—proving the importance of serving your loyal buyers.

“As consumers continue to experiment with new products and categories while also clinging to old favorites, loyalty disruptions persist into the pandemic. As a result, it’s crucial for brands to understand the makeup of their buyers,” said Lance Brothers, chief revenue officer, NCSolutions. “While loyalty-based segments have always been a focus for NCS clients, there is a need now more than ever for brands to more closely evaluate their own standing with customers. We are partnering with clients to optimize their campaigns to efficiently reach their most important customers and actively developing new solutions to support this critical need.”

CPG MONTHLY SPENDING TRACKER

NCS purchase data reveals consumer packaged goods spending increased substantially in December (20%) compared to November, while remaining 16% higher, year over year. This higher spend is attributable to consumers increasing their average basket size per shopping trip in the weeks leading up to the winter holidays in preparation for celebrations. Grocery spending remained elevated at 22% during what NCS has termed ‘the Home-Confined Phase’ of the pandemic (measured from March 22-December 31).

ABOUT THE CONSUMER SURVEY

The online survey was fielded between November 27-29, 2020. It has 2,004 respondents, ages 18+, with the results weighted to be representative of the overall U.S. population (variables available upon request). NCS provides data and regular insights to brands to help them optimize their advertising outreach and achieve improved return on advertising spend.