Fire up the Grill: NCS Finds American Consumers Increase Spending on Barbecue-related Consumer Packaged Goods Products in April

U.S. households increased purchases of seafood by 29% year-over-year, making it the top-growing barbecue category, while sales of outdoor essentials like suntan products rose 12%

NEW YORK, May 12, 2021 – U.S. consumers purchased barbecue-related consumer packaged goods (CPG) items at a faster clip this past April than they did over the same period in 2019, according to new analysis from NCSolutions (NCS), the leading company for improving advertising effectiveness for the CPG ecosystem. Also, consumers spent more in April 2021, compared to March 2021, than is typical at this time of year on a range of barbecue-focused products. NCSolutions found that nearly all barbecue categories grew faster over this period than compared to the same period in 2019.

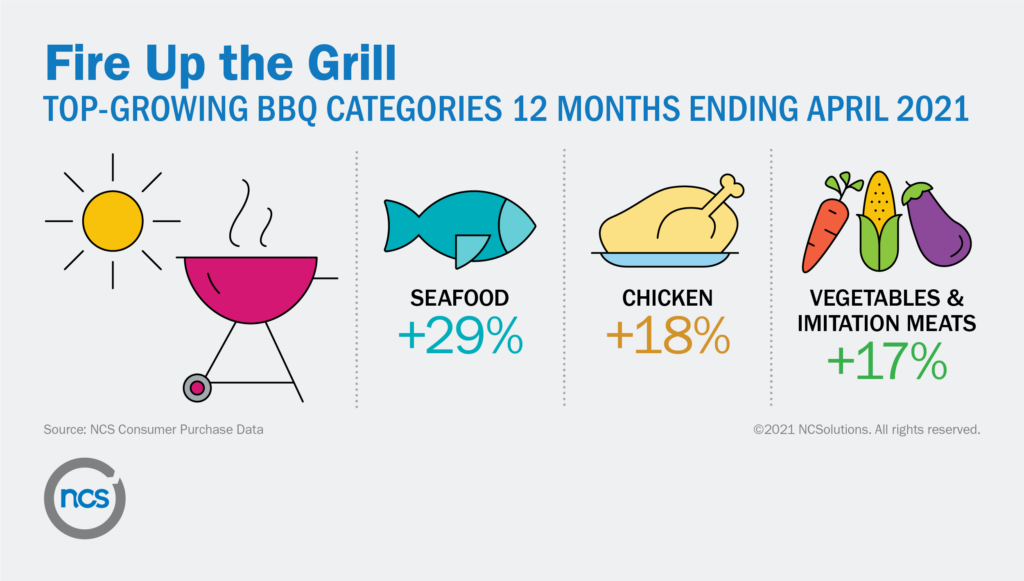

The top-growing barbecue-related categories for the 12 months ending April 2021 compared to the prior year were main courses: seafood by 29%, chicken by 18% and vegetables and imitation meats by 17%.

“Judging by the continued growth over the past year, we expect seafood to have another strong season as we approach Memorial Day Weekend 2021, one of the biggest weekends of the year for spending on CPG items,” said Linda Dupree, chief executive officer, NCSolutions. “In addition, Americans are making health a higher priority as the pandemic enters the next phase and are doing more shopping for healthy food items. Brands can further embrace this trend during barbecue season by promoting healthy products to consumers who are currently shopping the category.”

The outdoor essentials category, which includes items such as suntan products, charcoal, coolers and garden and patio supplies, showed strong growth from March to April 2021, increasing 19%. Household spending on meats rose 8%, while condiments and sauces grew 5% during the same period.

Spring is typically a season of weddings and graduations, and both types of events often coincide with outdoor parties. May is National BBQ Month, and Memorial Day and Fourth of July — holidays best known for barbecues — are on the horizon.

These shopping insights are in line with consumer attitudes as reported by the NCSolutions March 2021 Consumer Sentiment Survey, a nationally representative consumer survey with 2,017 respondents, ages 18 or older. In the survey, 28% of consumers said they plan to host or attend outdoor barbecues, and this proportion was even higher for consumers with children at home (36%).

NEW TREND: SAVORING SEA OVER LAND

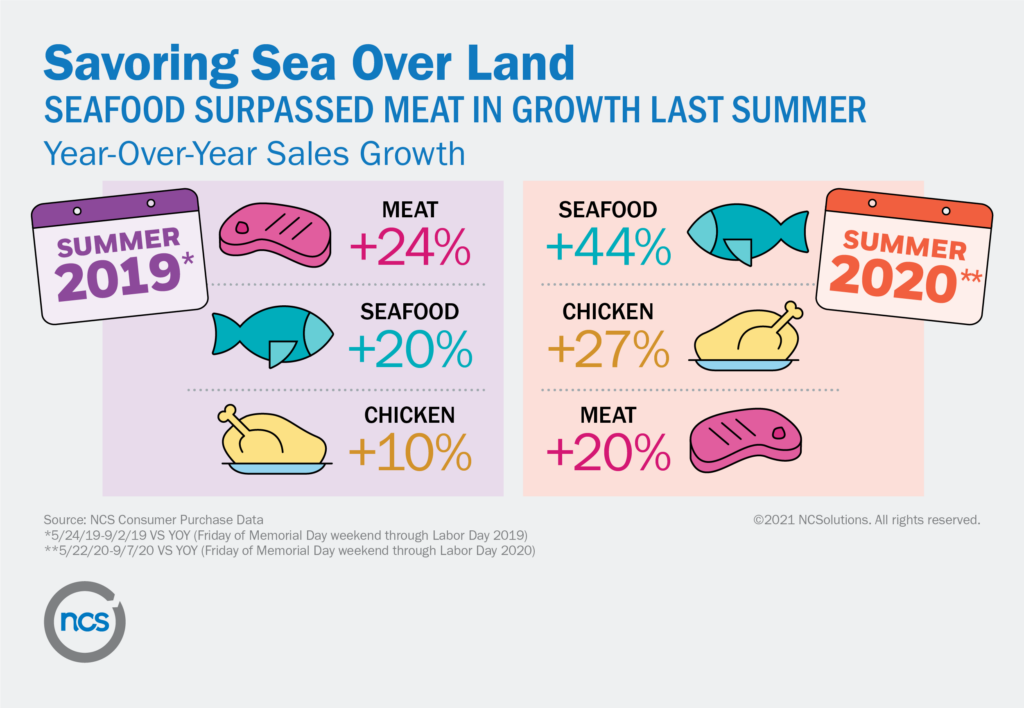

Looking at historical summer barbecue trends, seafood grew by 44% in summer 2020 vs year-over-year, surpassing chicken and meats, which grew at 27% and 20% respectively. This represents a change from Summer 2019, when meats were the top-growing category year-over-year (24%), followed by seafood (20%). This is a reflection of the meat shortage last April related to pandemic supply chain challenges and consumers’ substitution for seafood on the grill.

PREPPING THE OUTDOORS

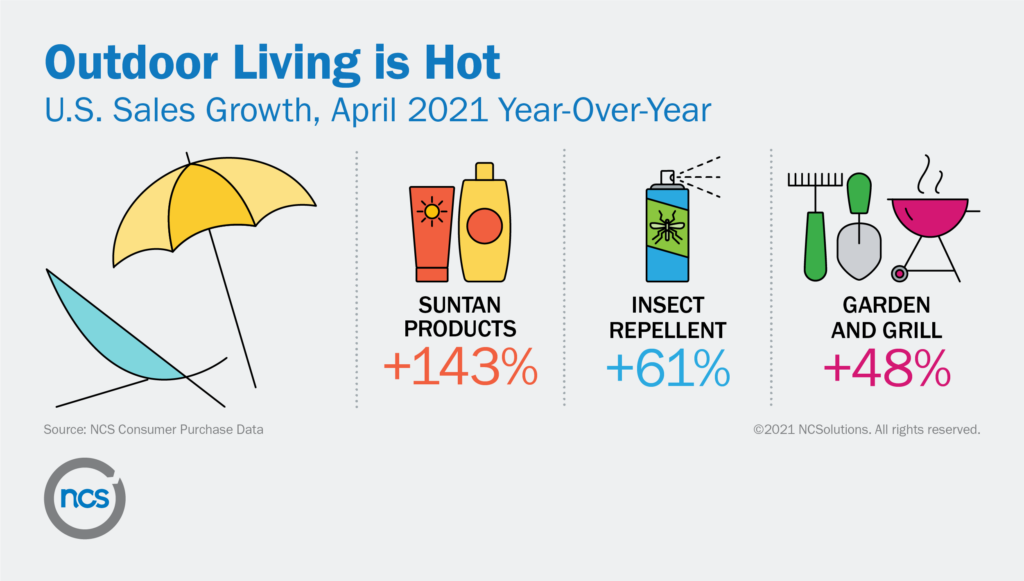

The outdoor essentials category was up 19% in April 2021, compared to March, and 22% year-over-year in April. Suntan products were up 143% year-over-year in April, insect repellent 61%, and garden and grill 48%, as consumers soaked up the outdoors this past April.

Consumer spending on paper goods and supplies like napkins, disposable dishes and food storage materials collectively increased in April, up 3% from March. Spending on this category reached an all-time high at the height of the pandemic, and consumers may still be working through their inventory: category spend in the 12 months ending April 2021 is 3%—the lowest of the barbecue-related categories.

ALSO ON THE MENU: HEALTHY DRINKS AND FRESH SNACKS

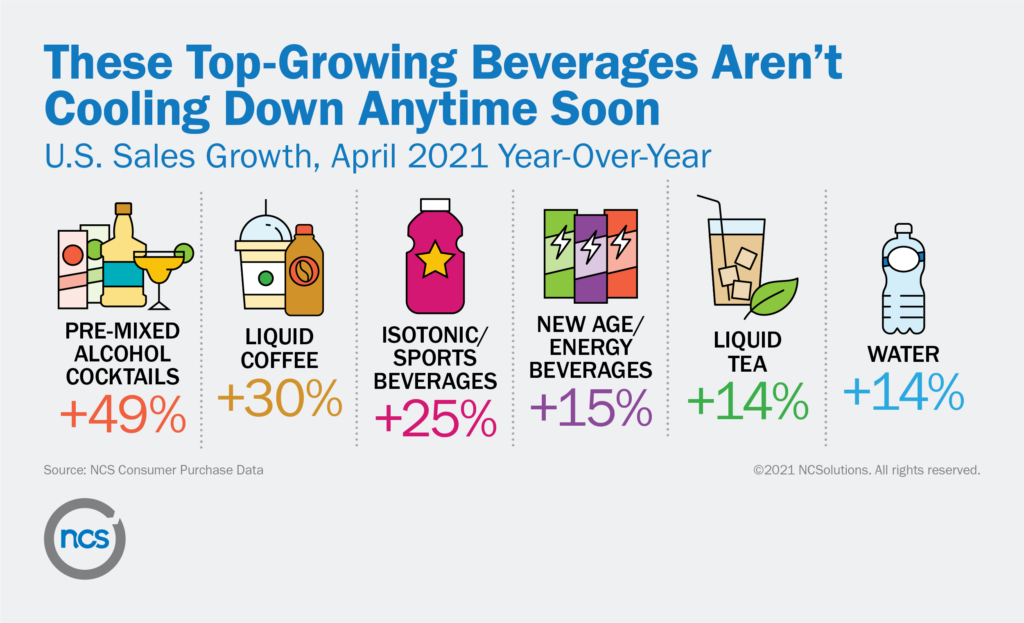

U.S. household spending on beverages in April was up 8% compared to April 2019. Though CPG spending overall was down compared to April 2020, some beverage categories stood out as growing, even when compared to April 2020 levels (when consumers loaded-up early on in the pandemic), reflecting a consumer need for celebration, energy and health/hydration in their beverages. Pre-mixed alcohol cocktails grew 49% in April 2021 year-over-year, liquid coffee by 30%, isotonic/sports beverages by 25%, new age beverages (which include energy drinks) by 15%, liquid tea by 14% and water by 14%.

“As we approach Memorial Day and July 4 weekends—the third and fourth-biggest weekends for these paper goods categories after Christmas and Thanksgiving—we expect sales of these items to jump,” Dupree says.

“The health trend is also creating significant interest in health-infused seltzers and energy drinks, as more consumers look to form new habits around healthy drinks and engage in more exercise to stay fit and build resilience,” Dupree said. “Beverage companies are continuing to enter the market with new products in these categories.”

Household spending on salty snacks and dips also increased by 5% in April 2021, compared to pre-pandemic buying in April 2019. Produce dips for dipping fruits and vegetables were a bright spot, up 14% in April 2021 year-over-year compared to salty snacks dips (down 18%), frozen dips (down 20%) and dairy-based dips (down 9%). This signals consumers are leaning toward snacking with fresher ingredients.

“Consumers turned to snacking during the pandemic as a comfort activity, a trend that remains steady even as Americans find themselves leaving home more often,” said Dupree. “Interest in salty snack food items such as nuts, crackers and dips remain high, and it seems reasonable to expect these treats to take up more space on the picnic table than in the past.”

GROCERY SPENDING REMAINS ELEVATED

Consumers are still buying at elevated levels. Though household grocery spend in April 2021 was 7% lower than April 2020 — a period of unusually high spending due to the start of the pandemic and Home-Confined Buying — April 2021 spend was 12% higher than April 2019, a year more indicative of pre-pandemic grocery shopping habits.

# # #