American Consumers Leave the Pandemic Behind – But Not the Beauty and Grooming Products They Discovered

- 37% started using beauty/grooming products they discovered during the pandemic

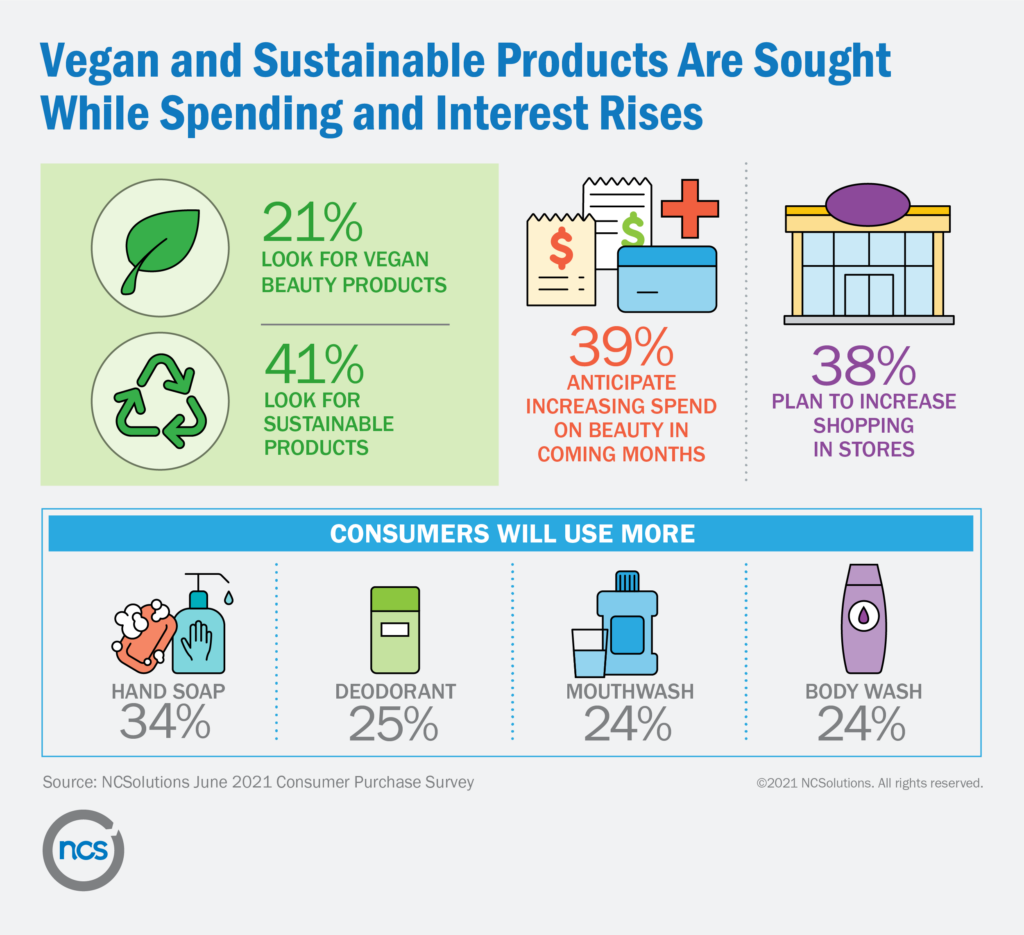

- Almost 40% plan to increase their spending on cosmetic and personal care products

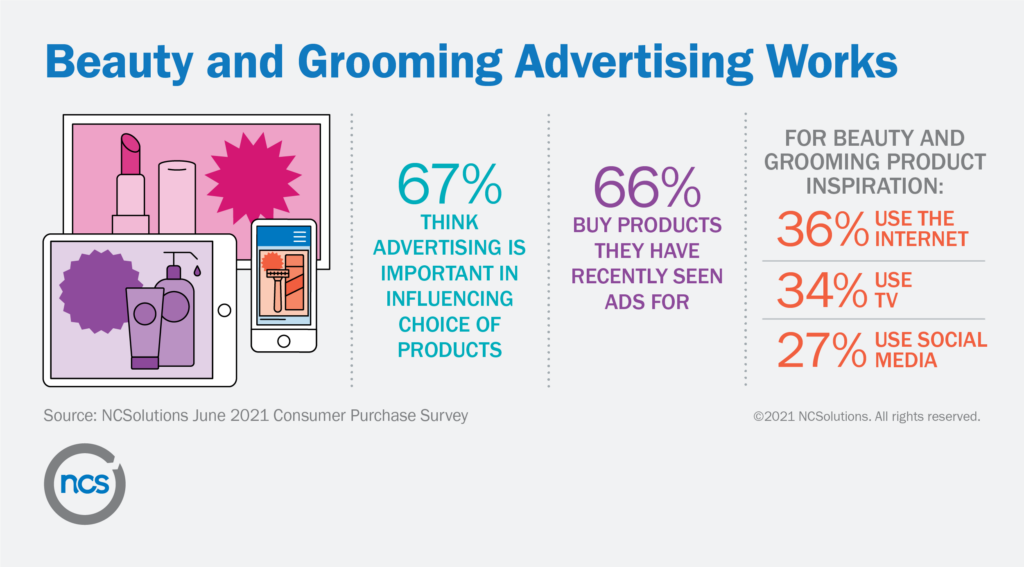

- 67% think advertising is important in influencing their choice of beauty/grooming products

- 38% say they will shop more in stores

- More than half (55%) of consumers plan to increase their usage of beauty products

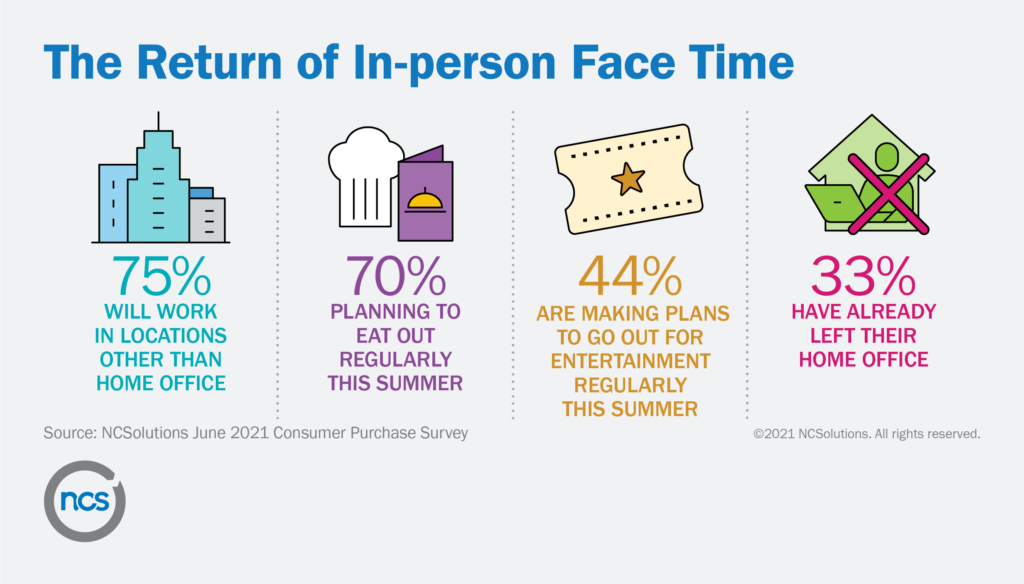

- Three out of four people will work in locations other than a home office

NEW YORK, June 21, 2021 – Beauty is back. Americans are returning to pre-pandemic beauty and grooming routines, with 39% of U.S. consumers saying they plan to spend more in the coming months on products that improve their appearance. The findings are from a new consumer survey commissioned by NCSolutions (NCS), the leading company for improving advertising effectiveness for the consumer packaged goods (CPG) ecosystem.

According to the survey, nearly 40% of consumers discovered new beauty and grooming brands during the pandemic and 37% say they started using those new products.

THE IMPORTANCE OF ADVERTISING IN THE BEAUTY AND GROOMING SEGMENT

NCSolutions’ nationally representative consumer survey was fielded between May 28 and June 1, 2021 with 2,094 respondents, ages 18 and older. The results represent consumer sentiment on beauty and personal care and also underscore the impact of advertising on consumer purchasing decisions. Two out of three (67%) Americans say advertising plays an important role in influencing their cosmetic and personal care choices.

“The power of advertising is abundantly evident in these survey results, in which 66% of consumers say they’ve bought a product after seeing an ad for it,” said Lance Brothers, chief revenue officer, NCSolutions. “Now is a pivotal time for beauty and personal care brands to remind people of the category and the products consumers might have left behind. It’s time to reinforce the need for the brand as everyone navigates a more social world that’s ‘face-to-face in-person’ and not just through a camera lens.”

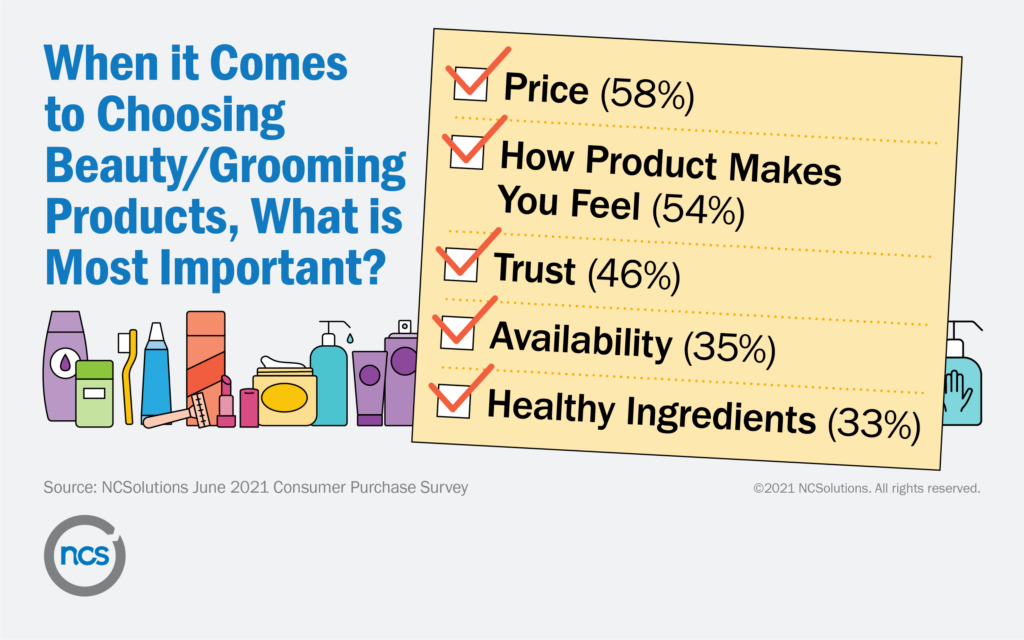

The survey revealed 58% of consumers say price is the top factor driving their decision to purchase a product, followed by how the product makes them look and feel (54%), their trust in the brand (46%), availability of the product (35%) and healthy ingredients (33%). When looking for beauty and grooming inspiration or ideas, 36% of consumers turn to the internet, 34% to television and 27% to social media.

“As more employees return to the office and mask mandates are lifted, Americans are once again refocusing on appearance and looking their best,” said Linda Dupree, CEO, NCSolutions. “This category is poised for growth, especially as we enter prime vacation season, followed by the reopening of schools and offices in late summer and the fall. The pressure will be on Americans to look and feel their best, which means sunscreen, makeup and deodorant brands, along with other beauty and grooming advertisers, have the opportunity now to reach, resonate and ultimately influence purchases.”

PLANS TO SPEND MORE

In the survey, 39% of American consumers say they anticipate increasing their spending on beauty products and 38% say they will increase their purchases in-store, rather than online. More than half (55%) of consumers plan to increase their usage of at least one beauty product; 34% say they’ll use more hand soap, 25% more deodorant, 24% more mouthwash, 24% more body wash and 17% more makeup.

The pandemic has driven greater interest in health, which also impacts the market for beauty and grooming products. According to the survey findings, 41% of consumers place a priority on sustainable beauty products and almost a quarter (21%) are seeking vegan product choices.

NCS PURCHASE DATA SHOWS AMERICANS ON THE GO

Further indication of American’s on-the-go is found in the sales of trial-sized beauty and personal care products. According to NCS’s CPG Purchase Data, trial-size products were up 87% in May 2021, compared to May 2020. Spending on suntan products was also 43% higher year-over-year as summer approaches.

Consumers also spent more on hair tonic (+21%), deodorant (+18%), hair spray and hair styling product (+7%) and oral hygiene (+6%) for the month, compared to the prior year (May 2020).

LOOKING GOOD

Consumers report they’ve returned to the beauty and grooming routines they followed pre-pandemic. According to the survey findings, 61% of consumers describe their current routine as “good to excellent,” which is close to pre-pandemic levels of 63%. By comparison, only 47% of consumers described their routines this way during the pandemic.

In addition, the percentage of Americans who say they’re spending more time on morning beauty and grooming routines increased. In the last month, 76% of Americans say they’re spending the same or more time getting ready in the morning, compared to 59% during the pandemic.

FACE TO FACE

Americans are also showing a strong desire to socialize more in-person. For instance, 70% of consumers say they plan to eat out at least several times per month, and 44% say they are likely to visit entertainment venues, like theaters and concert locations, multiple times a month this summer.

Employees also expect to be back in their workplaces early this summer. In fact, 33% say they’ve already left their home office. However, July (14%), August (18%) and September (11%) will see the biggest wave of workers leaving their home office to return to the employer’s location according to the consumer survey.

During the pandemic, over one-third (34%) of Americans worked in a home office, and one in four (25%) will continue to do so even as the pandemic wanes. According to the survey, three out of four (75%) of people say they’ll work in locations other than the home office. This encompasses those who will work at the employer’s physical location, in retail establishments, in the field and elsewhere.

CONSUMER SPENDING ON THE RISE

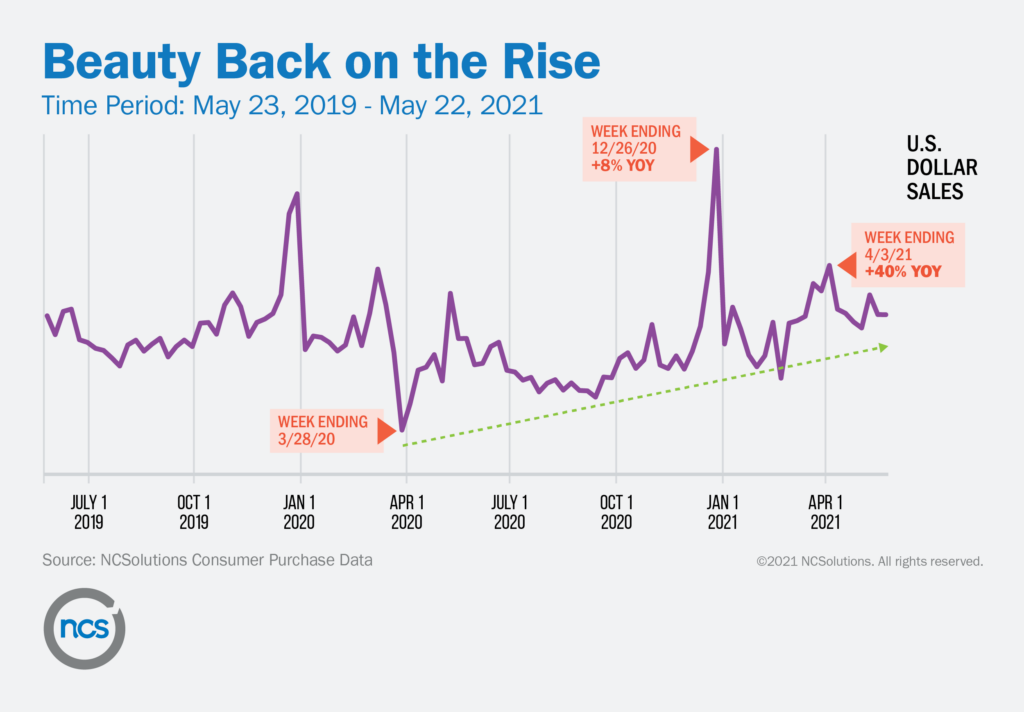

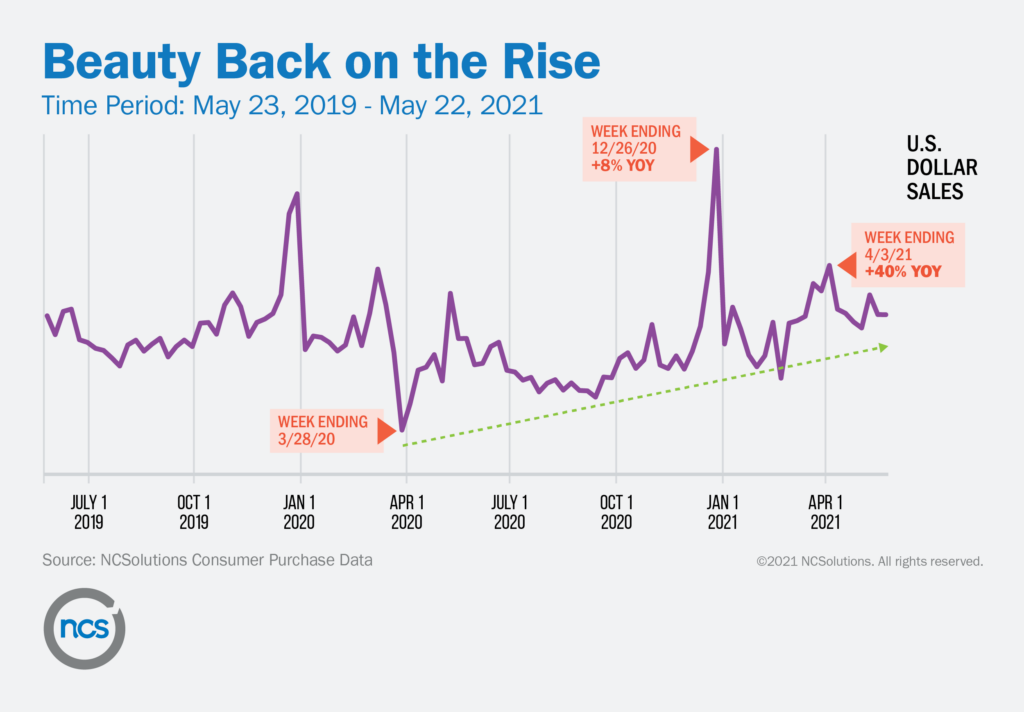

This increased need for these products is showing up in consumer spending according to NCS proprietary consumer purchase data. Beauty product sales have been on a gradual upward trajectory since their low at the height of the pandemic in March 2020. During Christmas week 2020, beauty product sales were up 8% year-over-year, and Easter week were up 40% year-over-year. The category has recovered back to 2019 levels.

OVERALL CPG SPENDING FOR MAY REMAINS ELEVATED

Overall household grocery spending across all categories remains elevated in May 2021, up 11% compared to May 2019.

ABOUT NCS

NCSolutions (NCS) makes advertising work better. Our unrivaled data resources powered by leading providers combine with scientific rigor and leading-edge technology to empower the CPG ecosystem to create and deliver more effective advertising. With NCS’s proven approach, brands are achieving continuous optimization everywhere ads appear, through purchase-based audience targeting and sales measurement solutions that have impacted over $25 billion in media spend for our customers. NCS has offices in NYC, Chicago, Tampa, and Cincinnati. Visit us at ncsolutions.com to learn more.

# # #