Treat Yourself! Pampering Trends

Americans REALLY like to pamper themselves. A whopping 81% of Americans say self-care is extremely or very important, and half say they’re willing to pay more for premium self-care products. Moisturizer and multivitamins are the most popular self-care products – by a wide margin.

When we surveyed over 1,000 Americans about their pampering preferences, we learned three-quarters (75%) of people practice self-care to improve their mental health, while 71% do it to improve their physical health.

We also learned that what drives a consumer’s purchase decisions often varies by generation. For instance, an eye-popping percentage (61%) of Gen Zers are completely or very likely to try a new self-care product based on a recommendation from an influencer or brand they trust.

Whether it’s incorporating “everything showers” into a weekly routine or establishing a wellness ritual, self-care has become less of an occasional indulgence and more of a lifestyle. Nearly half (49%) practice it every day, and another third (31%) practice some form of self-care weekly.

How Americans Practice Self-Care

For many Americans, the best way to feel good is to get their body moving. The number one self-care activity is exercise, but personal grooming (#2) and body care (#3) round out the top three.

A Zoomer may partake in the extensive “everything shower,” treating themselves from head to toe with products like face masks, hair oils, deep conditioners and bath oils. And while this may seem like a spa-like luxury, nearly half (48%) of Americans have engaged in an everything shower at home in the past three months.

The home might be the new spa, but it’s the new dentist office and nail salon too. In the past three months, 30% of Americans have whitened their teeth at home and 29% have given themselves a manicure or pedicure.

People are proving that beauty isn’t just on the outside – they’re taking care of their insides, too. The most popular supplements they’ve taken in the past three months are multivitamins (56%), probiotics (28%) and protein (28%).

How Americans Discover and Buy Self-Care Products

Self-care is a physical and mental activity that happens IRL. But the inspiration for specific self-care activities comes from digital channels.

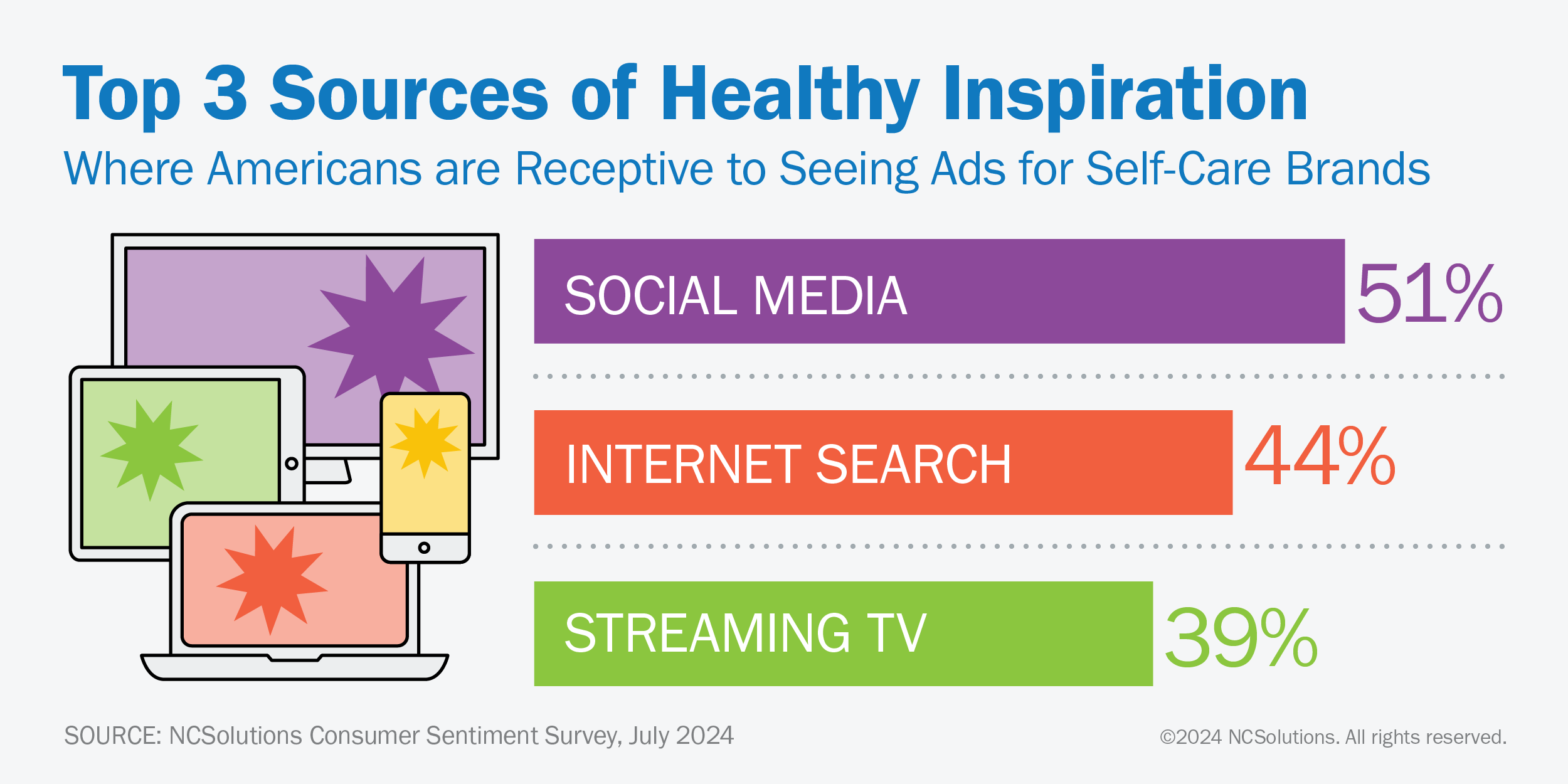

A millennial might slow their scroll on a self-care product ad while relaxing in a bubble bath and browsing their phone. Fifty-one percent of Americans are receptive to seeing ads on social media. Buyers are also likely to look at ads via an internet search (44%) or on streaming TV (39%).

Creator content like the popular “Get Ready with Me (GRWM)” stories, beauty store hauls and product unboxing videos are likely to sway viewers to buy something they see on screen. Forty-three percent of Americans are completely likely (18%) or very likely (25%) to try a new self-care product based on recommendations from influencers or trusted brands.

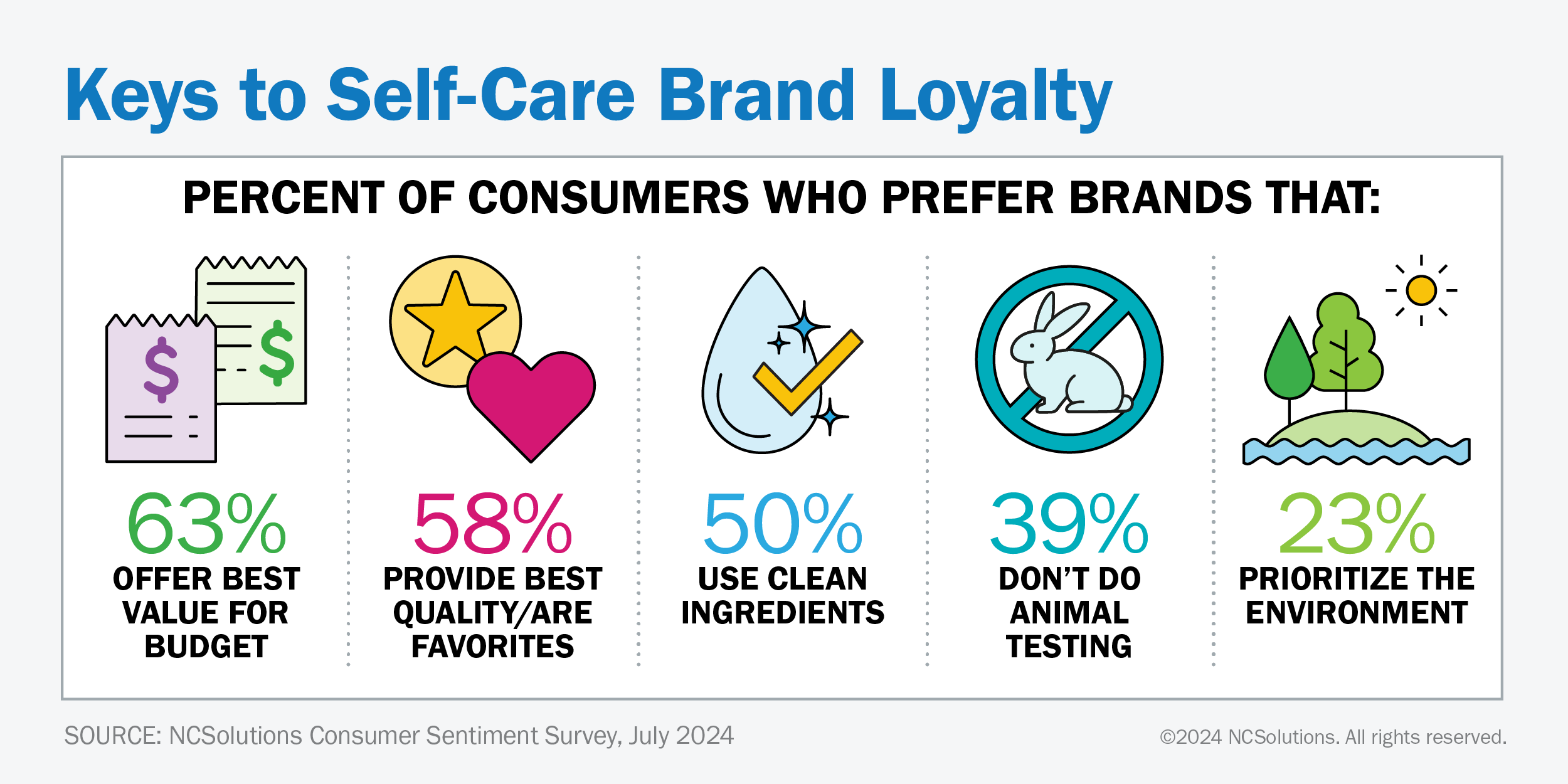

Brands looking to build loyalty can focus on delivering the attributes that consumers value the highest. Americans say they’re loyal to brands that provide the best value for the budget (63%), offer the best quality or are their favorites (58%). A notable share is also swayed by brands that act in environmentally conscious ways. Half of consumers say they’re loyal to brands that use clean ingredients, while 39% value a brand’s commitment to not using animal testing. Nearly one-quarter (23%) say they prefer brands that prioritize the environment.

There’s also a self-indulgent urge to splurge: half (50%) of Americans are willing to pay more for premium self-care products.

So, what are consumers treating themselves to? Moisturizer is the number one self-care product, with two-thirds (66%) of Americans saying they’ve purchased this in the last three months. That’s followed by teeth whitener (34%) and nail polish (31%).

Sales of vitamins, supplements, and nutrition powder rose 7.8%, 8.2%, and 28% in the first quarter of 2024, compared to the fourth quarter of 2023, according to NCS purchase data, indicating a high interest in health at the start of the new year. By comparison, in the second quarter of 2024, purchases of vitamins fell 11.7%, while supplements were down 4.5%, compared to the first quarter 2024, likely reflecting well-stocked medicine cabinets. Nutrition powder rose 1.26% over the same period.

Like certain beauty influencers, 37% of Americans are visiting superstores to find their self-care products. Others are ordering online for delivery or curbside pickup (16%) or heading to the drug store (13%).

Like certain beauty influencers, 37% of Americans are visiting superstores to find their self-care products. Others are ordering online for delivery or curbside pickup (16%) or heading to the drug store (13%).

How Men and Women Approach Self-Care

How different are men and women when it comes to self-care? They may have slightly different priorities, but they’re likely to agree on the value of self-care (83% of women vs. 79% of men said self-care is extremely or very important).

You’re likely to catch men working out – nearly half (48%) of men believe exercise is the most important self-care activity. It’s the top practice for women, too: A third (33%) of women consider exercise an important part of their self-care routine.

When choosing brands for their self-care products, men say effectiveness (34%) is the most important factor, while women are most concerned about price (36%).

Age-Defying Self-Care Trends

The way each generation goes about self-care reflects their stage of life. As they reach retirement age, boomers are focused on maintaining their physical health. Half (50%) of all boomers use exercise as a form of self-care. When they sit down, though, 40% of boomers are receptive to ads for self-care products on broadcast TV.

Meanwhile, millennials also say their top self-care activity is exercise (39%). Whether they’re on their phones or smart devices, millennials are watching ads for self-care products on social media (64%) and streaming TV (46%).

Members of Gen Z, having grown up online and now beginning to live on their own, are turning to social media to get and share self-care tips. Three-quarters (73%) of Gen Z said they’re receptive to experiencing ads for self-care products on social media, with 61% completely or very likely to try a new self-care product based on a recommendation from an influencer or brand they trust. Only 25% of Gen Z respondents rated exercise as their top self-care activity.

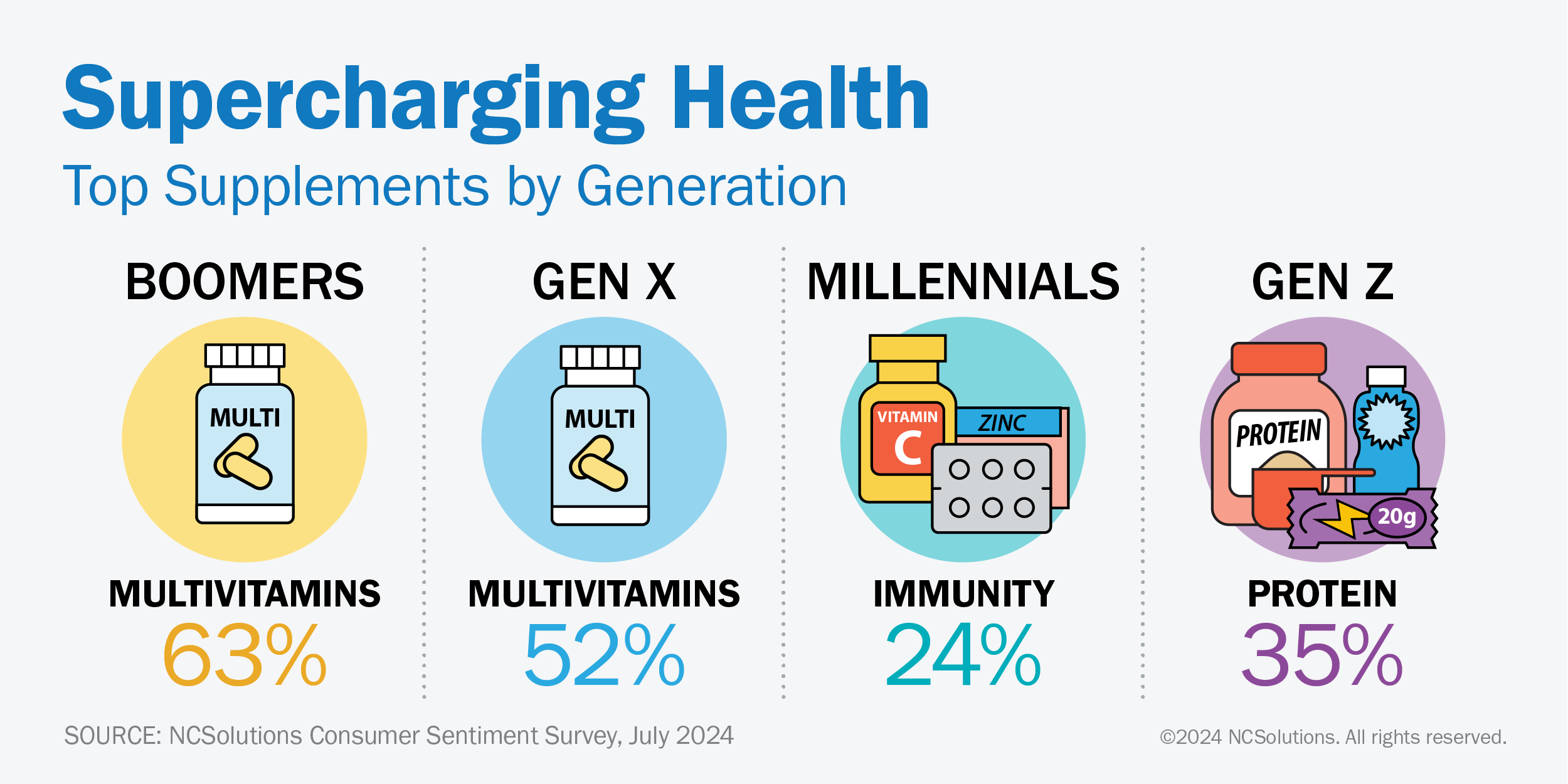

Most people are taking some form of dietary aid for their health, although it varies by generation. Roughly two-thirds (63%) of boomers have taken a multivitamin in the last three months, compared to 46% of Gen Z. Millennials are taking immunity (24%), herbal (23%), and CBD (19%) supplements to maintain their wellbeing. Nineteen percent of Gen X say they haven’t taken a supplement in the last three months, a significant difference compared to other generations. However, about one in four take protein (26%), probiotics (24%) or sleep aids (24%). Gen Z is bulking up, with one-third (35%) of the demographic reporting having taken a protein supplement recently.

But there’s one self-care activity that will never go out of style: People of all ages, including 37% of Gen Z, 32% of millennials, 29% of Gen X and 16% of boomers – are treating themselves to a classic bubble bath.

With today’s hectic lifestyle, it can be difficult to slow down and find time for self-care. But while we might not have extra hours for an everything shower every day, fitting in a quick workout, doing your hair or even popping a supplement can be an easy way to pamper yourself.

About the Consumer Sentiment Survey

The online survey of 1,077 respondents, age 18 or older, was fielded from July 12-15, 2024. Responses presented in this survey were weighted by location, education, income and other demographics to be representative of the overall population.

About the NCS Purchase Data

NCS provides purchase insights to brands to help them target, optimize, measure, and enable sales-based outcomes.NCS’s representative and balanced consumer CPG purchase data set consists of the industry’s preeminent and comprehensive sources. It is inclusive of actual purchase data (transaction information) from big-box retailers, supermarkets, drug stores, convenience stores and other retail channels at which American households buy CPG products spanning 340+ grocery categories. The NCSolutions purchase data was analyzed in July 2024.

Fair Use

When using this data and research, please attribute by linking to this study and citing NCSolutions.