Increased Demand for Consumer Packaged Goods Creates Atypical Growth Opportunity for Brands

New NCSolutions Loyalty Study Confirms Strong Return on Ad Spend for Brands Invested in Advertising and Brand Loyalty

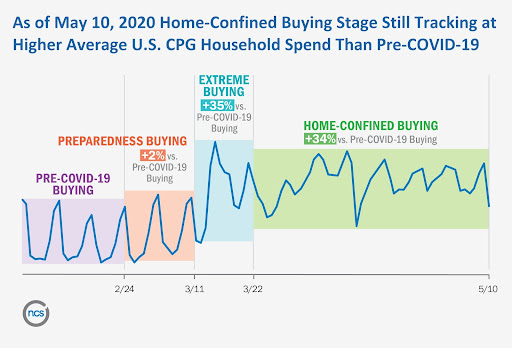

NEW YORK, May 15, 2020 — The unprecedented 34% growth of consumer packaged goods (CPG) sales since March 22 of this year has created a significant growth opportunity for major brands to grow their market share. Consumer brands with high levels of brand equity and consumer trust, and which consistently advertised through the current marketplace disruption, have been the major beneficiaries of consumer loyalty and expanded market share.

These are among the key findings of a new brand loyalty study released today by NCSolutions (NCS), the leading company for improving advertising effectiveness for the consumer packaged goods ecosystem. The study, called “Loyalty in the Time of COVID: Why Branding and Targeted Advertising Matter More Now than Ever,” concludes that consumers are gravitating towards the brands they know and trust during this elevated time of CPG purchasing.

NCS analyzed the purchase behavior of more than 51 million U.S. households and the sales and advertising data for 50+ brands (3-4 brands for 16 different advertisers) for a spectrum of brands (growing, declining, stable, etc.) throughout various stages of the pandemic.

Against the backdrop of exceptionally high overall CPG sales, up 34% from March 22 through May 10, 2020, during the Home-Confined Buying phase, the opportunity cost for brands stands in stark contrast. The findings underscore the importance of investing in advertising, brand loyalty and brand equity — especially during a crisis. Brands that advertise strategically to gain market share, convert new buyers and increase loyalty will come out on top.

According to “Loyalty in the Time of COVID,” there are five key trends CPG brands need to consider in the quarantine economy.

1. Growing brands grew more.

During a period of pantry loading and extreme buying, brands that were growing prior to the COVID-19 pandemic saw their share disproportionately increase. As buying behavior settled into a period of home confinement, many growing brands came out with an even stronger leadership position.

2. Declining brands lost share.

The opposite is true for declining brands, which saw their market share decrease in Home-Confined Buying, even though sales went up during Extreme Buying. Both growing and declining brands saw increased sales from new buyers. However, declining brands have an opportunity to move first-time and trial buyers up the loyalty ladder, as supply chain and inventory issues create reasons for consumers to sample new brands. Additionally, in a few cases, the declining brands observed switched from talking to their loyal buyers to a focus on garnering new buyers. While new buyers are critical, delivering messages that resonate with loyal buyers should be prioritized.

“In response to milestone life events — in which our collective experience is transformed, like COVID-19 — consumers often make radical changes to their purchasing and media habits,” said Leslie Wood, chief research officer, NCSolutions. “With more time at home, people are consuming significantly more media, and they have an increased need for CPG items. Many major advertisers have asked us to develop targets for consumers during major life changing events like weddings, having a baby or buying a home. These are often very small targets which are very time-bound. Today, our collective experience is being transformed for a world-wide life changing event: COVID-19. Consumers are trying new items, expanding their cooking methods and are being exposed to buying many new items. This is an opportunity for brand equity development. How individual brands fare in this environment depends on the advertising decisions they make.”

When faced with stock-outs — and with limited services available — consumers have been forced to try new brands and buy in new categories. Over-the-counter pain relievers and personal hygiene are two prime examples of categories that experienced significant sampling during this period, giving brands an opportunity to interact with trial buyers, and potentially turn them into loyal buyers of the brand.

3. Loyals remained loyal, even amidst high levels of sampling.

Brands with a highly loyal customer base that don’t experience seasonal fluctuations also fared well during the periods of extreme buying and home confinement. While they didn’t benefit from a major spike in sales due to a stock up, their loyal buyers remained loyal, even purchasing slightly more of the product than they otherwise would have.

“Cultivating loyalty among brand buyers is crucial to building a steady following, and it’s often the most effective and efficient strategy for advertisers,” said Lance Brothers, chief revenue officer, NCSolutions. “When sales are driven by loyalists, brands can worry less about disruptive events like a pandemic because they know the consumer will continue to reach for their item.”

4. Consumers seek brands that afford them comfort and stability during this crisis.

During the Home-Confined Buying stage, consumers are gravitating to the brands they know and trust, and which might remind them of their childhood. During the extreme buying phase of COVID-19 related shopping, they focused on addressing their physical needs, stocking up on food, water and over-the-counter drugs. Once pantries were loaded, however, consumers sought to satisfy their desires. Mid- and high-range brands have experienced a disproportionately higher share of sales than bargain brands that compete on price. Splurging on a more high-end version of their favorite products meets emotional desires that are otherwise lacking during this pandemic.

“During a time of great uncertainty, consumers have turned to brands they have a history with. Brands that are predictable and that bring them comfort, but perhaps brands they haven’t bought for a while,” said Steven Tramposch, vice president of client consulting, NCS. “Some nostalgic brands that had been in a decline for several years have seen incredible growth, which might extend the life of their brand for 20 years. A whole new generation was exposed to a set of products and brands as their parents sought comfort from a time past.”

5. Advertising works – especially in a quarantine economy.

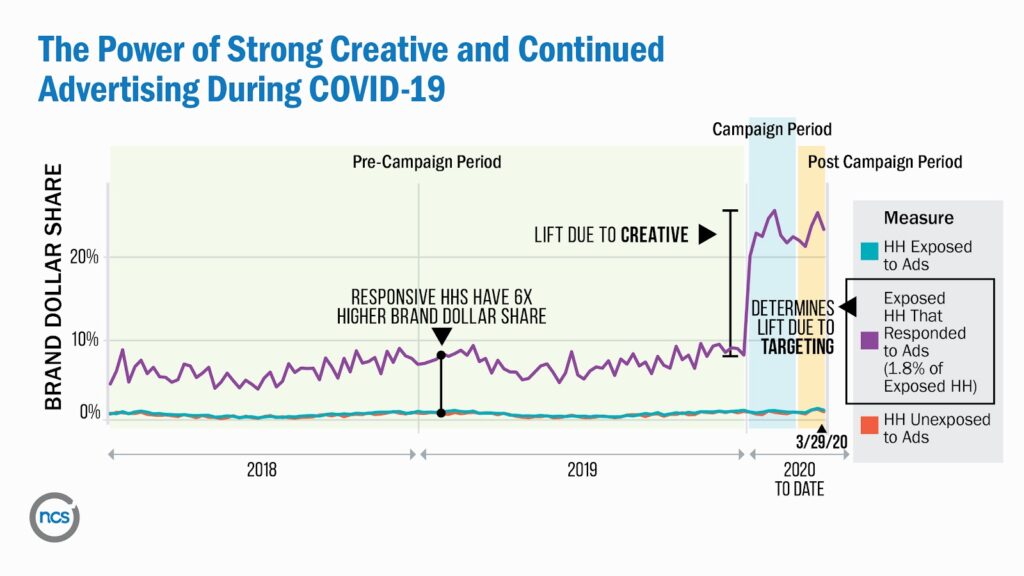

Brands with aggressive advertising strategies prior to — and during — the pandemic achieved higher growth than brands that had pulled back their advertising, according to the study. These findings prove advertising works — even in the quarantine economy — and is consistent with previous NCS research, which shows brands that succeed are the brands that advertise, to the right customers, consistently.

To find out how brands can advertise more efficiently in the next phase of the quarantine economy, download the e-book: “Loyalty in the Time of COVID: Why Branding and Targeted Advertising Matter Now More than Ever.” For the latest trends in consumer purchasing behavior, visit us online or drop us a line at the email below.

###