Consumer Packaged Goods Sales Down 8% In April From March Peak, as Buying Patterns Adapt To Home-confined Lifestyles

Hand sanitizer, baking supplies, drink mixers and frozen poultry categories show the most growth compared to a year ago

NEW YORK, MAY 13, 2020 — American household consumer packaged goods (CPG) spending declined 8% in April compared with March, a month characterized by a period of extreme buying as COVID-19 concerns took root in the U.S. In March 2020, grocery sales increased by an unprecedented 36% compared with March 2019. These findings are part of new data released by NCSolutions (NCS), the leading company for improving advertising effectiveness for the consumer packaged goods ecosystem.

Though April sales are lower than the preceding month, the new findings show household sales for the month are at significantly higher levels than usual. Household grocery spending in April 2020 is up 28% when compared with sales figures from 2019.

The NCS data also reflect an adaptation to new buying patterns shaped by the COVID-19 pandemic. April represents the first full month of the Home-Confined Buying stage as most Americans shelter in place.

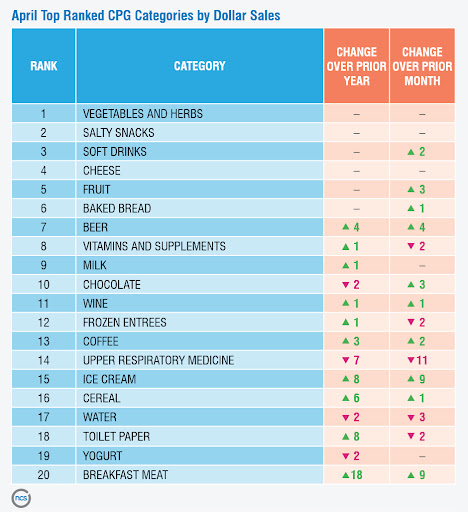

In addition, the data show American households continuing the return to pre-COVID-19 purchase preferences — with a few key differences. When comparing the top-ranked categories to a year ago, NCS found the grocery basket mix in April closely resembles the contents of consumer carts prior to the pandemic. However, some items reflect the unique purchasing behaviors driven by the situation. U.S. households are purchasing more sweets and convenience foods, such as ice cream and frozen entrees, than they did in April 2019.

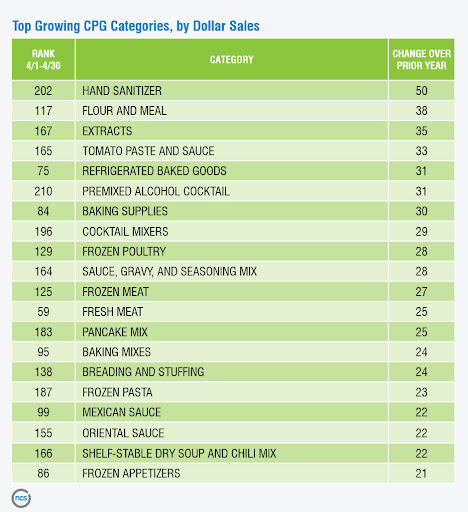

“As American households settled into their quarantine routines during April, several new consumer trends have emerged. Largely, we see shoppers returning to many of their CPG purchasing patterns pre-COVID-19, but being at home has sparked new interest in several items,” said Linda Dupree, CEO, NCSolutions. “Shoppers are looking to their CPG purchases for comfort, convenience, variety and entertainment, which is clearly illustrated through the major changes in category sales rankings. It seems everyone has taken up baking recently; baking supplies are selling at extraordinarily high levels for the spring season, surpassed only by the holiday season, along with cocktail mixers and comfort foods.”

There are some growing CPG categories that have moved up in importance in the shopping cart and spending levels when compared to spending in 2019. Hand sanitizer remains strong as the top growing category. Flour and other baking ingredients, tomato sauces, refrigerated baked goods, various types of cocktails and mixers and frozen poultry also rank at the top of the growing category list.

CPG CATEGORY TRENDS: APRIL 2020-MAY 2020

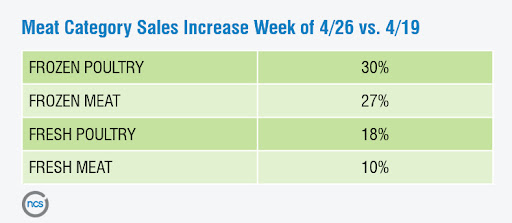

Meat, baking ingredients and toilet paper are among the categories to watch in the month of May. Meat sales peaked on March 13, during a phase of consumer Extreme Buying with sales 211% higher than one year prior. Since recent news of potential shortages and supply chain disruptions, meat sales are again on the rise. During the week of April 26th, consumers hurried to the store to stock up, especially on frozen products. In the same week, sales in almost every meat department category increased over sales from the previous week. Frozen poultry also topped all meat categories with a 30% increase in sales over the week prior.

Also, flour, which became one of the most coveted and scarce grocery items during April, closed out the month 38 spots higher in NCS’ CPG category ranking than the same time last year. Across the board, shoppers have prioritized baking ingredients, as they cook more at home resulting in an overall increase in spending.

“What does all of this mean for CPG brands? The extreme period of atypical household buying behavior appears to be settling down, creating a significant marketing moment for brands and marketers to refocus and double-down on courting their loyal buyers,” said Lance Brothers, chief revenue officer, NCSolutions.

“For brands that have been fortunate to gain some market share during this time, they have an opportunity to maintain that gain. They need to ensure they are ‘in-market’ and visible for their new customers. Building loyalty among new buyers will set up their brands for success in the short and long-term,” said Brothers.

Sales of toilet paper dropped after the March 11-12 peak, mainly due to stock-out challenges, with 70% of U.S. stores out of stock for some part of the day on March 23. As toilet paper became more available at the beginning of April, it started to rise in rank again in the American shopping basket. More on the toilet paper story here.

For the latest trends in consumer purchasing behavior, visit us online or drop us a line at the email below.

###